41 relationship between coupon rate and ytm

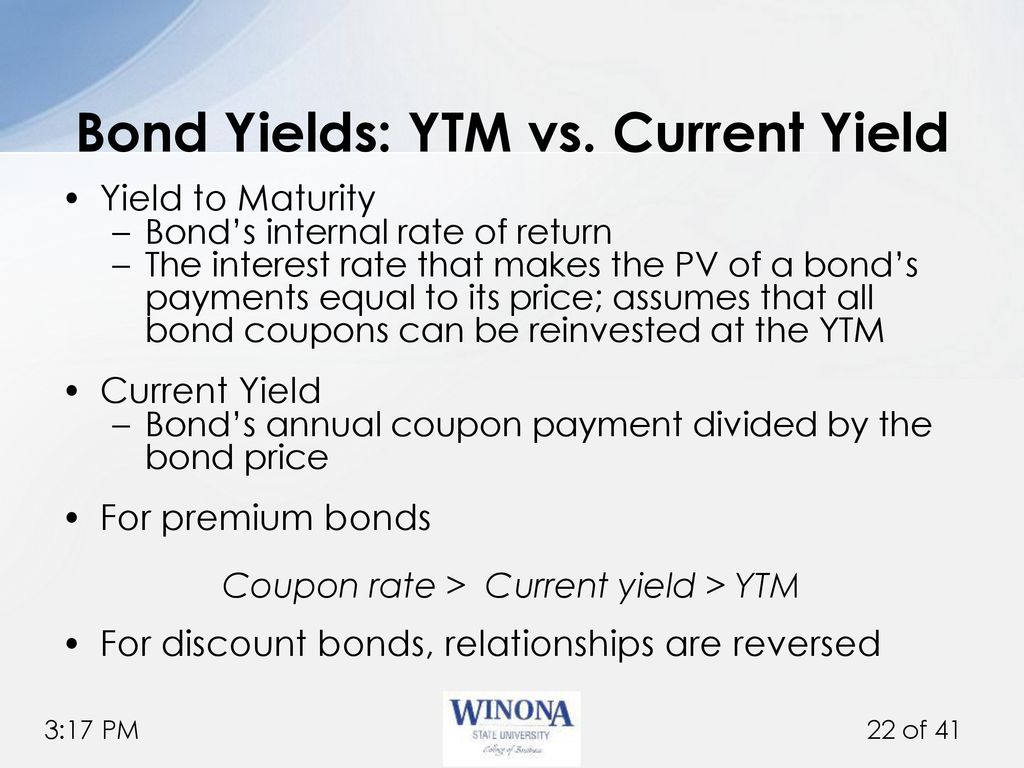

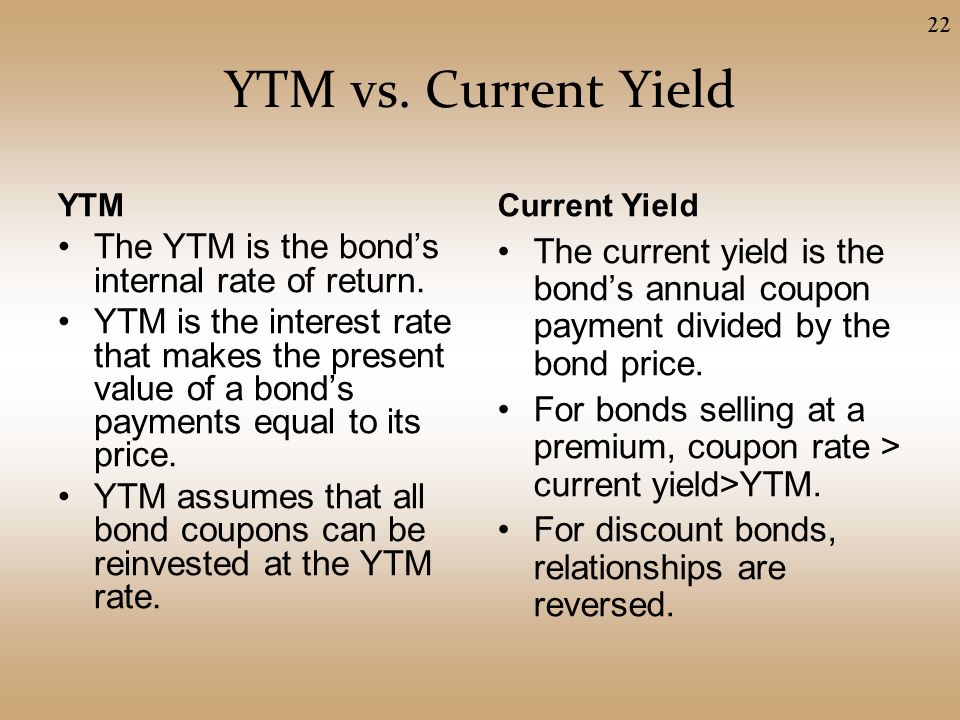

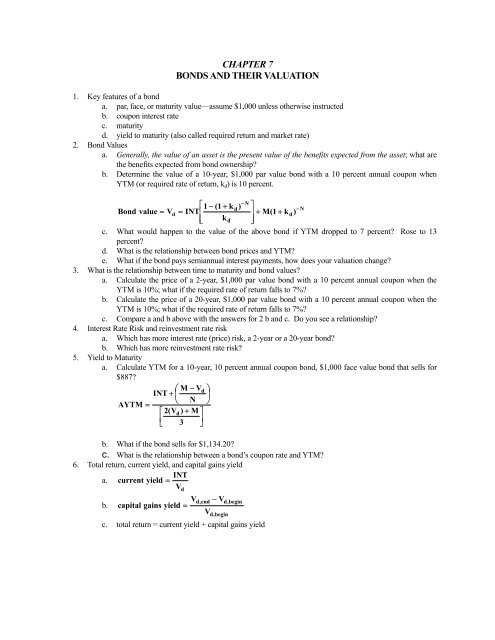

Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per ... Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's yield, or coupon rate, is computed by dividing its coupon payment by its face value. An updated yield rate can be computed by dividing its coupon by ...

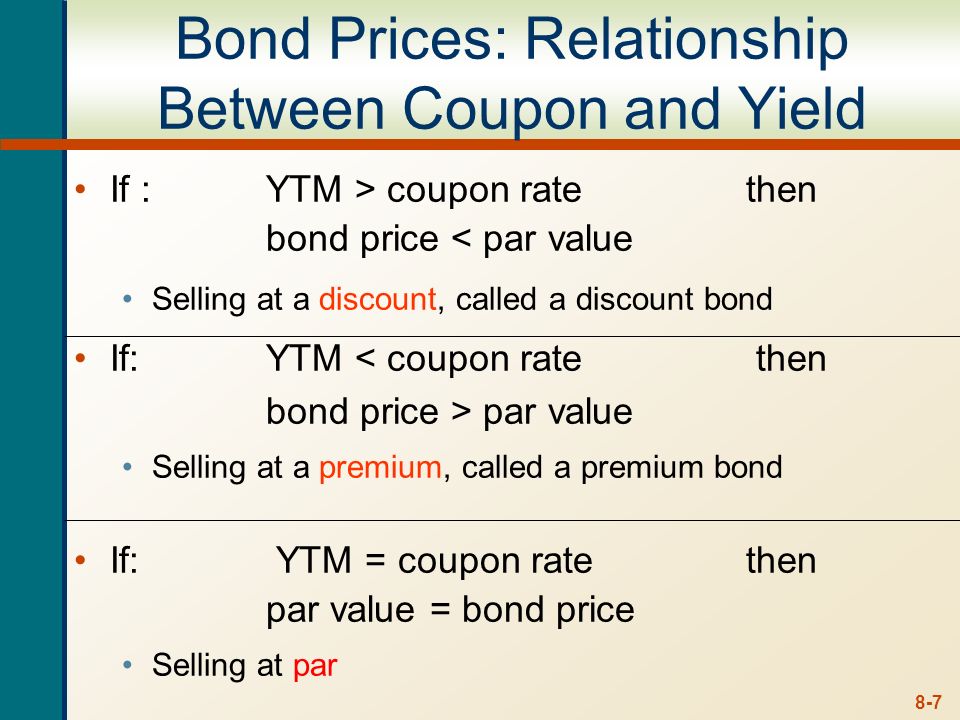

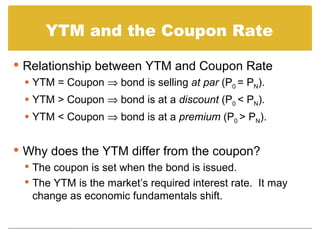

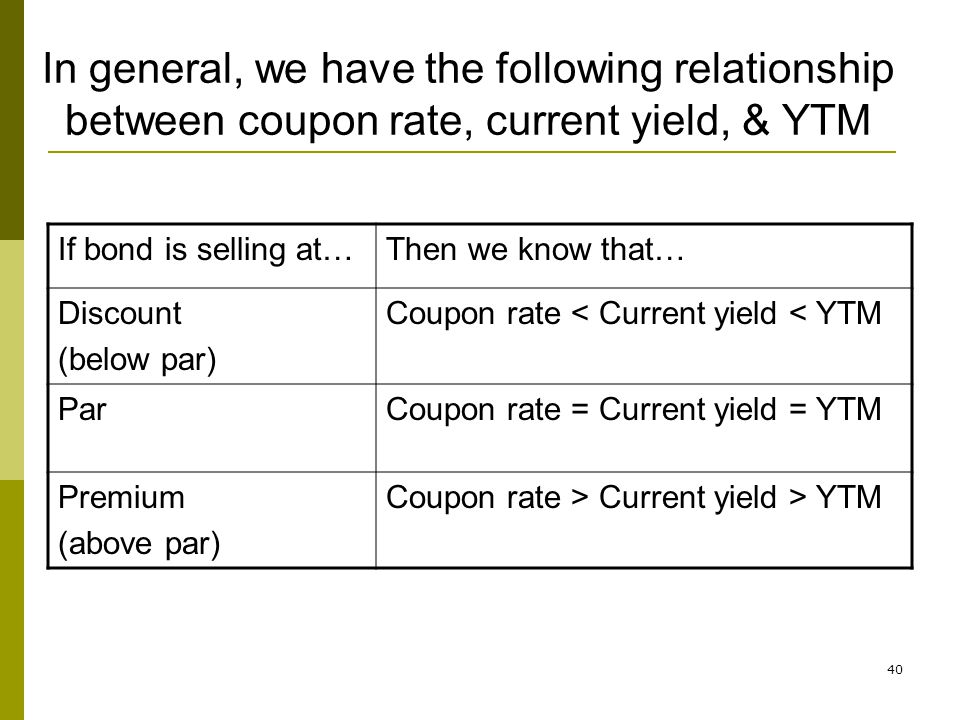

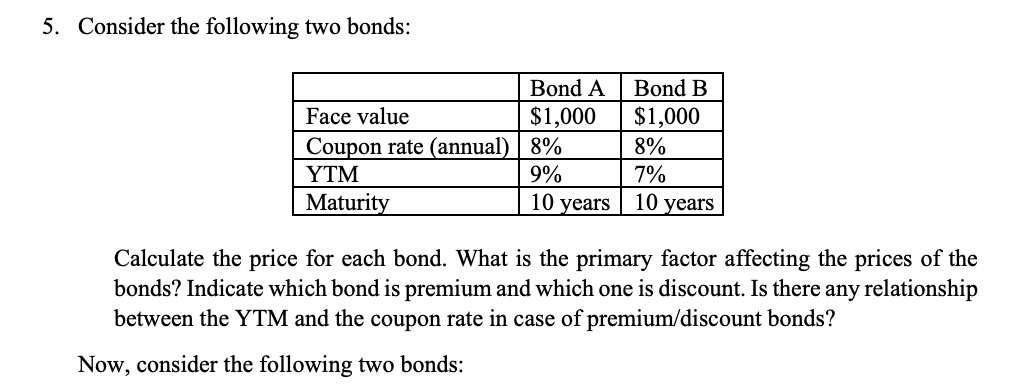

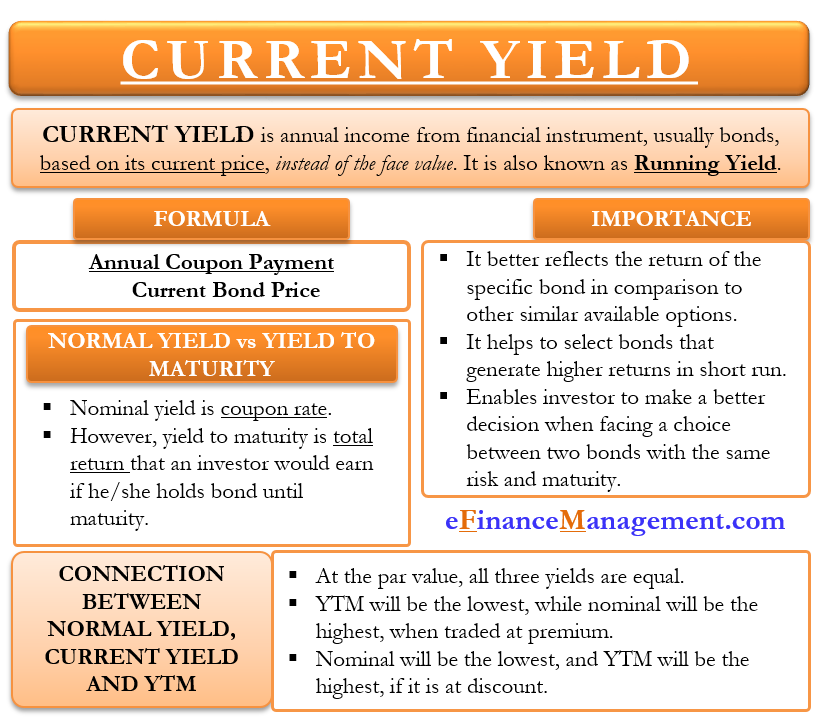

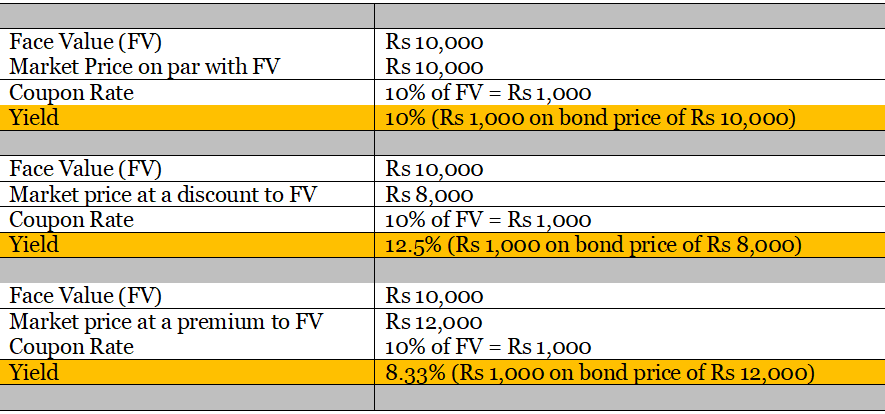

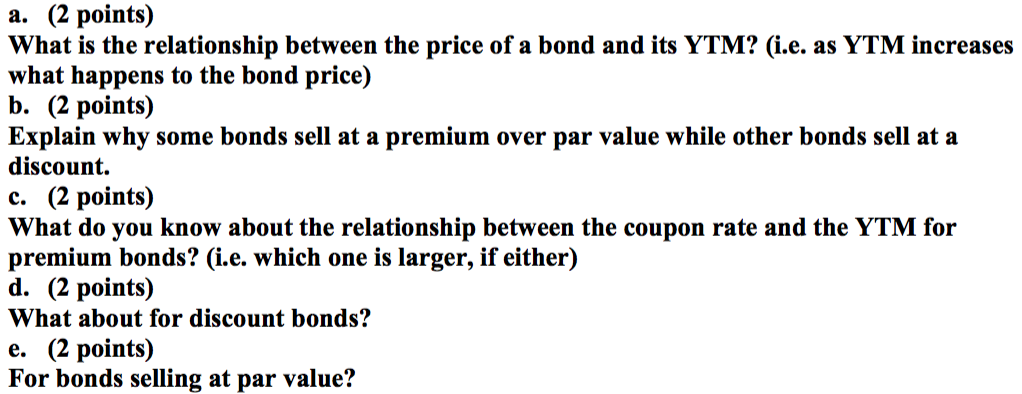

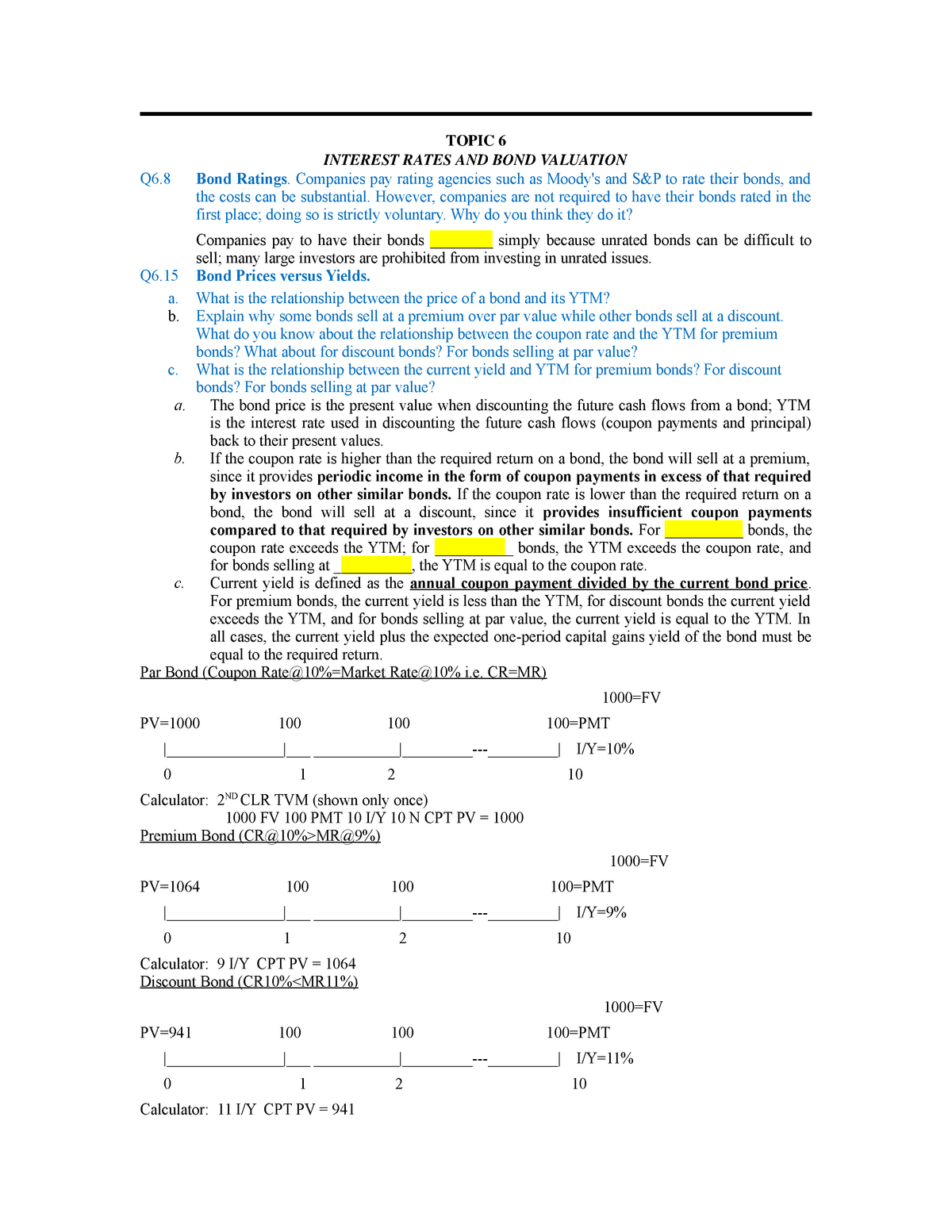

Reserve Bank of India The relationship between yield to maturity and coupon rate of bond may be stated as follows: When the market price of the bond is less than the face value, i.e., the bond sells at a discount, YTM > > coupon yield. When the market price of the bond is more than its face value, i.e., the bond sells at a premium, coupon yield > > YTM.

Relationship between coupon rate and ytm

What relationship between a bond's coupon rate and a bond's yield ... If the bond yield is less than the bond's coupon rate, then the bond will trade at a premium. Likewise, if the bond yield is more than the bond's coupon rate, ... Fixed Income - Investopedia Dec 05, 2021 · Matilda Bond: A bond denominated in the Australian dollar and issued on the Australian market by a foreign entity that seeks to raise capital from Australian investors. A Matilda Bond may attract ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Relationship between coupon rate and ytm. Don't currency hedge your equity portfolio - Monevator Sep 29, 2022 · The relationship between currency movements and inflation also causes a natural hedge. Since the UK imports pretty much everything – including labour – a lower value of GBP increases inflation in the long run. But at the same time, a lower value of GBP would boost the value of your (unhedged) foreign portfolio. What is the relationship between the coupon rate and the YTM for ... The bond price is higher than the par value when the coupon rate > YTM. The coupon rate is applied to calculate the coupon payments by multiplying the coupon ... Difference between Coupon Rate And Yield To Maturity - Angel One Another difference between these two metrics is that the YTM represents the average rate of return that an investor is likely to experience over the bond's ... Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Zero-Coupon Bonds: Characteristics and Examples Zero-Coupon Bond Yield-to-Maturity (YTM) Formula. The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price. Learn How Coupon Rate Affects Bond Pricing Oct 11, 2022 ... The yield-to-maturity only equals the coupon rate when the bond sells at face value. The bond sells at a discount if its market price is below ... Concept 82: Relationships among a Bond's Price, Coupon Rate ... Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity, and Market Discount Rate (Yield-to-Maturity) · A bond's price moves inversely with its YTM ... Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube Aug 3, 2021 ... We go through the coupon rate formula, current yield formula, and the yield to maturity formula. We also explain the difference between the ...

FIN 3403 - CH 7 - Bonds and Bond Valuation Flashcards - Quizlet YTM Current Yield 4.06% ... 5 million bonds with a par value of $5000 each for 10 years at a coupon rate of 7%. ... relationship between market interest rates and ... Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year, whereas yield of maturity ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Fixed Income - Investopedia Dec 05, 2021 · Matilda Bond: A bond denominated in the Australian dollar and issued on the Australian market by a foreign entity that seeks to raise capital from Australian investors. A Matilda Bond may attract ...

What relationship between a bond's coupon rate and a bond's yield ... If the bond yield is less than the bond's coupon rate, then the bond will trade at a premium. Likewise, if the bond yield is more than the bond's coupon rate, ...

Post a Comment for "41 relationship between coupon rate and ytm"