39 present value formula coupon bond

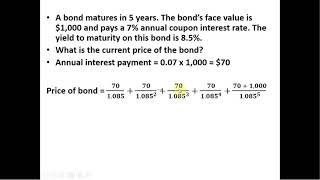

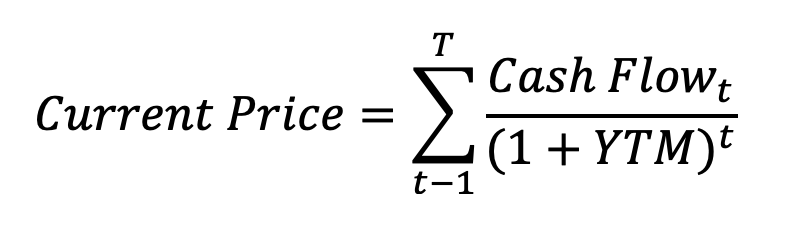

Bond Valuation: Formula, Steps & Examples - Study.com A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ {... Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Coupon Rate Formula | Step by Step Calculation (with Examples) Again the bond will trade at a discount when the coupon rate is lower than the market interest rate, which means the price of the bond Price Of The Bond The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity.

Present value formula coupon bond

Using the Present Value Formula to Value Bonds - HKT Consultant You can use the annuity formula from Chapter 2 to value the coupon payments and then add on the present value of the final payment. Thus, the bond can be valued as a package of an annuity (the coupon payments ... In this case, we already know that the present value of the bond is 144.99% at a .3% discount rate, so the yield to maturity must be ... Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. Bond Valuation Formula & Steps | How to Calculate Bond Value - Video ... A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ {...

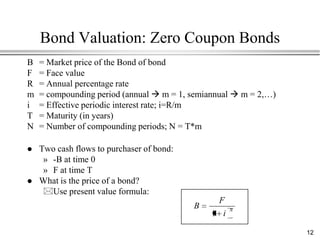

Present value formula coupon bond. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] Present Value with Continuous Compounding - finance formulas PV - Continuous Compounding. The present value with continuous compounding formula is used to calculate the current value of a future amount that has earned at a continuously compounded rate. There are 3 concepts to consider in the present value with continuous compounding formula: time value of money, present value, and continuous compounding. Present Value Formula - CalculatorSoup Formulas to calculate the present value of future amounts, annuities and perpetuities. Find the present day value of a future sum with interest compounding and payments. Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Present Value Coupon Bond - bizimkonak.com How to Calculate Present Value of a Bond - Pediaa.Com. CODES (Just Now) Step 1: Calculate Present Value of the Interest Payments. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the … Visit URL. Category: coupon codes Show All Coupons How to calculate the present value of a bond — AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor. Bond Present Value Calculator The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments) How to Calculate Present Value of a Bond - Pediaa.Com Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond F = Face value of the bond R = Market t = Number of time periods occurring until the maturity of the bond Step 2: Calculate Present Value of the Face Value of the Bond

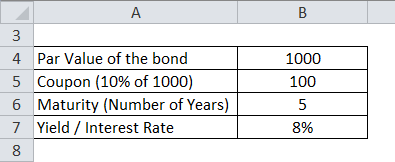

Bond Formula | How to Calculate a Bond | Examples with Excel Template PV of kth Periodic Coupon Payment = (C / n) / (1 + r / n) k PV of Face Value = F / (1 + r / n) n*t Step 7: Finally, the bond formula can be derived by adding up the PV of all the coupon payments and the face value at maturity as shown below. Bond Price = C * [ (1 - (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] Bond Formulas - thismatter.com The most common bond formulas, including time value of money and annuities, bond yields, yield to maturity, and duration and convexity. ... From Duration and Convexity, with Illustrations and Formulas. Bond Value = Present Value of Coupon Payments + Present Value of Par Value. Duration Approximation Formula; Duration = P-- P + 2 × P 0 (Δy) Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033 How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping Suppose the discount rate was 7%, the face value of the bond of 1,000 is received in 3 years time at the maturity date, and the present value is calculated using the zero coupon bond formula which is the same as the present value of a lump sum formula. The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond ...

Bond valuation - Wikipedia Present value approach. Below is the formula for calculating a bond's price, which uses the basic present value (PV) formula for a given discount rate. This formula assumes that a coupon payment has just been made; see below for adjustments on other dates.

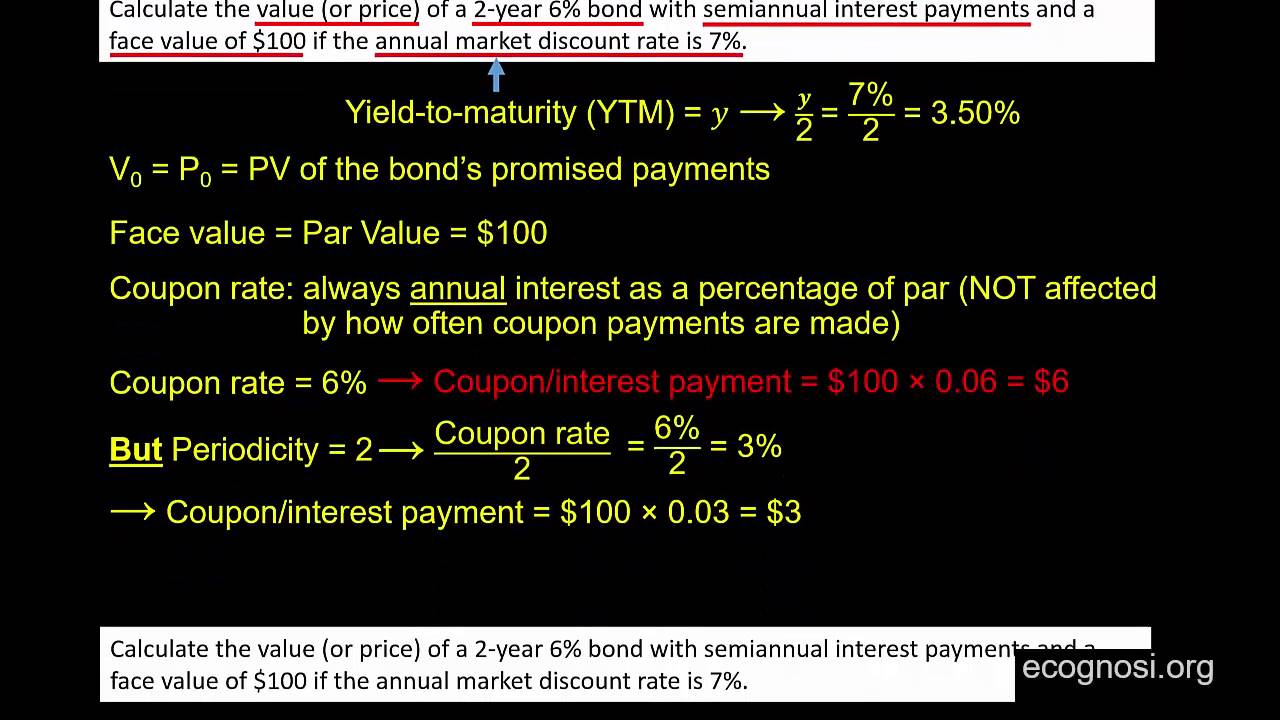

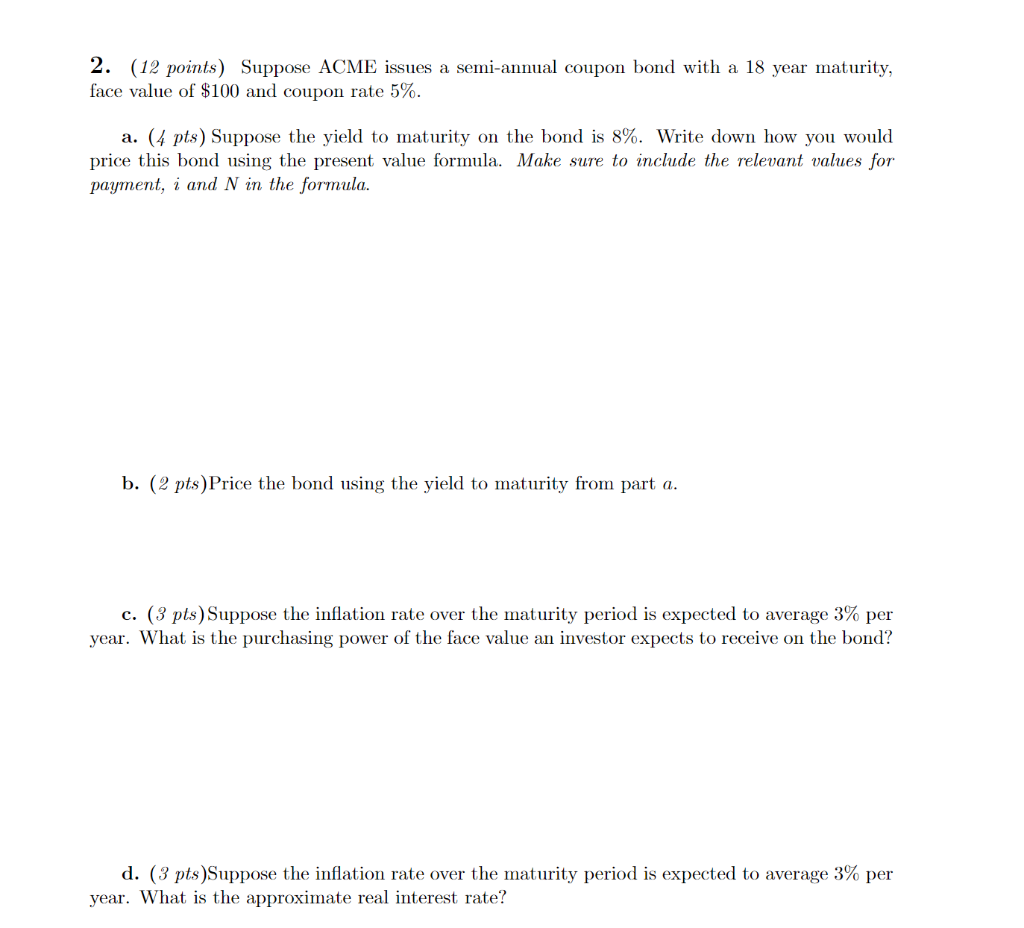

Bond Price | Definition, Formula and Example - XPLAIND.com Since the interest is paid semiannually the bond coupon rate per period is 4.5% (= 9% ÷ 2), the market interest rate is 4% (= 8% ÷ 2) and number of coupon payments (time periods) are 20 (= 2 × 10). Hence, the price of the bond is calculated as the present value of all future cash flows as shown below:

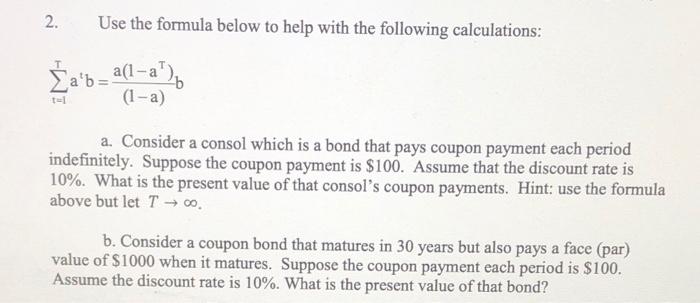

Bond Valuation Overview (With Formulas and Examples) To find the bond's present value, we add the present value of the coupon payments and the present value of the bond's face value. Value of bond = present value of coupon payments + present value of face value Value of bond = $92.93 + $888.49 Value of bond = $981.42 A natural question one would ask is, what does this tell me?

Valuing Bonds | Boundless Finance | | Course Hero F = face value, i F = contractual interest rate, C = F * i F = coupon payment (periodic interest payment), N = number of payments, i = market interest rate, or required yield, or observed / appropriate yield to maturity, M = value at maturity, usually equals face value, and P = market price of bond.

How to Calculate PV of a Different Bond Type With Excel - Investopedia The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a...

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. ... Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate.

How to Figure Out the Present Value of a Bond - dummies The present value of the bond is $100,000 x 0.65873 = $65,873. The present value of the interest payments is $7,000 x 3.10245 = $21,717, with rounding. Add the present value of the two cash flows to determine the total present value of the bond. In this example, $65,873 + $21,717 = $87,590. About This Article

Coupon Payment | Definition, Formula, Calculator & Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037. They carry a coupon rate of 6.5% while the payments are made semiannually. Its current yield is 4.63% while its yield to maturity is 3.92%. The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2].

Par Bond - Overview, Bond Pricing Formula, Example Example of a Par Bond. A bond with a face value of $100 and a maturity of three years comes with a coupon rate of 5% paid annually. The current market interest rate is 5%. Using the bond pricing formula to mathematically confirm that the bond is priced at par, Shown above, with a coupon rate equal to the market interest rate, the resulting bond ...

Present Value Calculator The present value formula applies a discount to your future value amount, deducting interest earned to find the present value in today's money. Present Value Formula and Calculator. The present value formula is PV=FV/(1+i) n, where you divide the future value FV by a factor of 1 + i for each period between present and future dates.

Bond Valuation: Calculation, Definition, Formula, and Example Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36 Present value of face value = 1000 / (1.015) 4 = 942.18 Therefore, the...

Bond Valuation Formula & Steps | How to Calculate Bond Value - Video ... A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ {...

Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

Using the Present Value Formula to Value Bonds - HKT Consultant You can use the annuity formula from Chapter 2 to value the coupon payments and then add on the present value of the final payment. Thus, the bond can be valued as a package of an annuity (the coupon payments ... In this case, we already know that the present value of the bond is 144.99% at a .3% discount rate, so the yield to maturity must be ...

Post a Comment for "39 present value formula coupon bond"