43 us treasury bonds coupon rate

Treasury Bonds | AOFM Treasury Bond lines. Coupon and Maturity (click for term sheet) Outstanding. (face value, AUD million) ISIN. 2.25% 21 November 2022. 26,500. AU000XCLWAW9. 5.50% 21 April 2023. US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC Latest On U.S. 30 Year Treasury. U.S. Treasury yields move lower as investors look ahead to Jackson Hole 6 Hours AgoCNBC.com. Treasury yields climb higher on Friday August 19, 2022CNBC.com. Bond ...

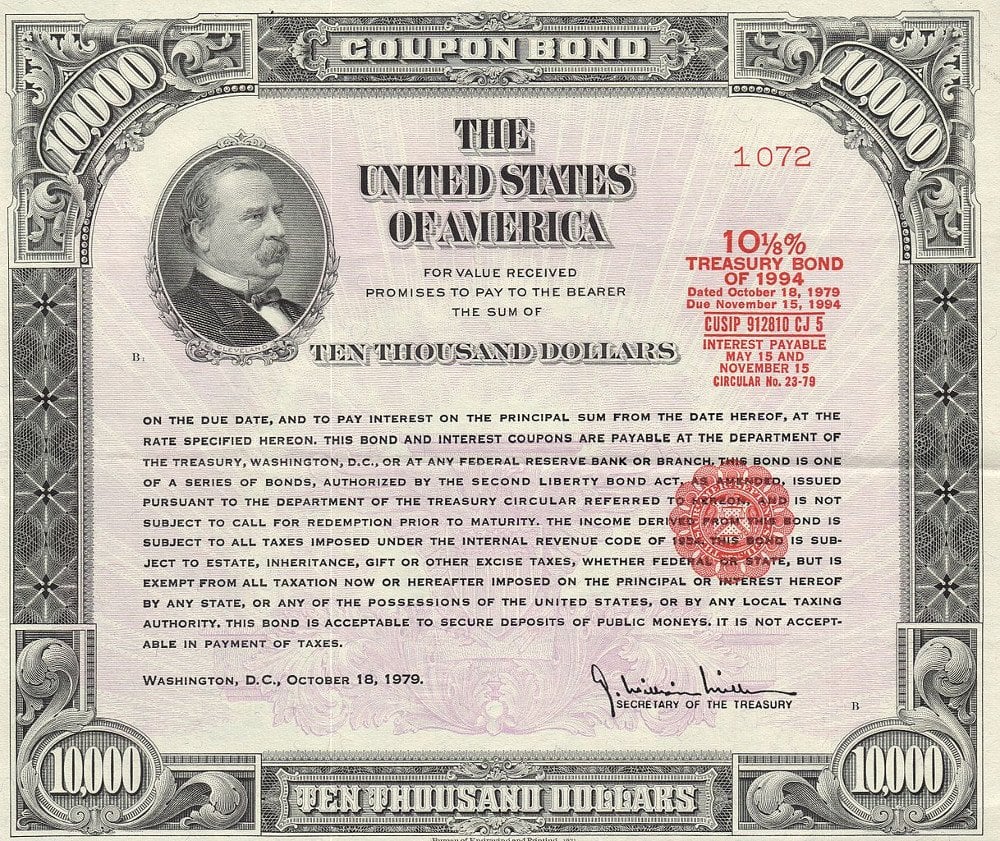

› us-treasury-bondsUS Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

Us treasury bonds coupon rate

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms . Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest. The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions.) Coupon Rate Calculator | Bond Coupon As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value home.treasury.gov › services › bonds-and-securitiesBonds and Securities | U.S. Department of the Treasury TreasuryDirect.gov website These are just a few of the popular topics found at the TreasuryDirect.gov website: Log on to your TreasuryDirect account Create a new account in TreasuryDirect so you can buy and manage Treasury savings bonds and securities Forms Savings bonds as gifts Death of a savings bond owner Frequently asked questions The Bureau of the Fiscal Service The Bureau of the Fiscal ...

Us treasury bonds coupon rate. Coupon Interest and Yield for eTBs | australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. TreasuryDirect - Home - Savings Bonds Cases you send by mail may take us as long as 13 weeks to process. Processing of FS Form 5444, for account authorization, currently takes about 8 weeks. The annual purchase limit for Series I savings bonds in TreasuryDirect® is $10,000. › treasury-bondsWhat Are Treasury Bonds? Definition, Types, How to Invest Jul 28, 2022 · Treasury bonds. $100. Discount, coupon, or premium ... Interest rate risks: As are all bonds, Treasury bonds are subject to ... Treasury securities are available either through the US Treasury or ... Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)...

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by the... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond... US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve. From the data product: US Federal Reserve Data Releases (60,686 datasets) Refreshed 10 hours ago, on 26 Aug 2022. Frequency daily. Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding ... - Home Cases you send by mail may take us as long as 13 weeks to process. Processing of FS Form 5444, for account authorization, currently takes about 8 weeks. The annual purchase limit for Series I savings bonds in TreasuryDirect® is $10,000.

U.S. Treasury Bond Futures Quotes - CME Group 30-Year Treasury CVOL Index. Track forward-looking risk expectations on 30-Year Treasuries with the CME Group Volatility Index (CVOLTM), a robust measure of 30-day implied volatility derived from deeply liquid options on 30-Year U.S. Treasury Bond futures. CODE: 10 Year Treasury Rate - YCharts Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 3.03%, compared to 3.11% the previous market day and 1.35% last year. This is lower than the long term average of 4.27%. United States Government Bonds - Yields Curve Bond Price - with different Coupon Rates Fx; 0% 1% 3% 5% 7% 9%; 30 years: 3.309%: 37.66: 56.50: 94.18: 131.86: 169.54: 207.22: 20 years: 3.549%: 49.79: 63.94: 92.24: 120.54: 148.84: 177.14: 10 years: 3.098%: 73.71: 82.19: 99.17: 116.14: 133.12: 150.09: 7 years: 3.189%: 80.27: 86.46: 98.83: 111.20: 123.57: 135.95: 5 years: 3.197%: 85.44: 90.00: 99.11: 108.21: 117.32: 126.43: 3 years: 3.384%: 90.50: 93.31: 98.92: 104.54: 110.15: 115.77: 2 years: 3.382% U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate - Forbes With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an...

Bonds Center - Bonds quotes, news, screeners and educational ... - Yahoo! Treasury Yield 5 Years. 3.1810. +0.0020. +0.06%. ^TNX. Treasury Yield 10 Years. 3.0540. +0.0170.

› markets › rates-bondsUnited States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . 0 ...

10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 10 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of August 23, 2022 is 3.05%.

Treasury Coupon Issues | U.S. Department of the Treasury The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS). The Treasury Breakeven Inflation Curve (TBI curve) is derived from the TNC and TRC yield curves ...

30 Year Treasury Rate - 39 Year Historical Chart | MacroTrends Interactive chart showing the daily 30 year treasury yield back to 1977. The U.S Treasury suspended issuance of the 30 year bond between 2/15/2002 and 2/9/2006. The current 30 year treasury yield as of August 23, 2022 is 3.26%. Show Recessions.

United States Treasury security - Wikipedia Treasury notes ( T-notes) have maturities of 2, 3, 5, 7, or 10 years, have a coupon payment every six months, and are sold in increments of $100. T-note prices are quoted on the secondary market as a percentage of the par value in thirty-seconds of a dollar. Ordinary Treasury notes pay a fixed interest rate that is set at auction.

United States Government Bond 10Y - 2022 Data - 1912-2021 Historical ... United States Government Bond 10Y US 10 Year Note Bond Yield was 3.06 percent on Wednesday August 24, according to over-the-counter interbank yield quotes for this government bond maturity. United States Government Bond 10Y Generally, a government bond is issued by a national government and is denominated in the country`s own currency.

markets.ft.com › data › bondsUS 10 year Treasury Bond, chart, prices - FT.com Aug 26, 2022 · Green bond rate increased to 3% Aug 26 2022; Don’t mess with ESG in Texas Aug 26 2022; India tipped to join pivotal JPMorgan bond index Aug 26 2022; Using the ‘Pottery Barn rule’ in the Treasury market Aug 26 2022; The carbon footprint fixation is getting out of hand Aug 25 2022; BlackRock labels Texas ‘anti-competitive’ over ESG ...

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ...

Rates & Bonds - Bloomberg Get updated data about global government bonds. Find information on government bonds yields, bond spreads, and interest rates.

Domestic bonds: USA, Bonds 3% 15may2047, USD (US912810RX81) It is represented by United States Treasury bonds (issued by the United States Department of the Treasury to finance government spending) and by non-marketable securities. ... New issue: Issuer USA issued bonds (US912810TK43) with the coupon rate of 3.375% in the amount of USD 16953 mln maturing in 2042: 18/08/2022: US Treasury Securities:

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Long-Term Rates and Extrapolation Factors. Treasury ceased publication of the 30-year constant maturity series on February 18, 2002 and resumed that series on February 9, 2006. To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds.

US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Yield Open 3.11% Yield Day High 3.113% Yield Day Low 3.095% Yield Prev Close 3.106% Price 97.00 Price Change +0.0312 Price Change % +0.0352% Price Prev Close 96.9688 Price Day High 97.0625 Price...

Individual - Series I Savings Bonds - TreasuryDirect Current rate: 9.62% for bonds issued May - October 2022: Minimum purchase: Electronic bond: $25 Paper bond: $50 : Maximum purchase (per calendar year): Electronic bonds: $10,000 Paper bonds: $5,000 : Denominations: Paper bonds: $50, $100, $200, $500, $1,000 Electronic bonds: $25 and above, in penny increments : Issue method:

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

home.treasury.gov › services › bonds-and-securitiesBonds and Securities | U.S. Department of the Treasury TreasuryDirect.gov website These are just a few of the popular topics found at the TreasuryDirect.gov website: Log on to your TreasuryDirect account Create a new account in TreasuryDirect so you can buy and manage Treasury savings bonds and securities Forms Savings bonds as gifts Death of a savings bond owner Frequently asked questions The Bureau of the Fiscal Service The Bureau of the Fiscal ...

Coupon Rate Calculator | Bond Coupon As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value

Post a Comment for "43 us treasury bonds coupon rate"