45 formula for coupon payment

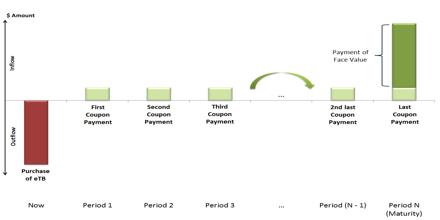

What is a Coupon Payment? - Definition | Meaning | Example Twenty years later, Mark earns his last payment of $300, plus his original investment of $10,000. In total, Mark has turned his $10,000 into $13,000 over 10 years, which was a safe, and smart, investment for him. Summary Definition. Define Coupon Payments: Coupon payment means the interest installment paid to bond holders. Prompt Payment: Interest Calculator 30/06/2022 · If a payment is less than 31 days late, use the Simple Daily Interest Calculator. If a payment is more than a month late, ... The Formula. This is the formula the calculator uses to determine simple daily interest: P(r/360*d) P is the amount of principal or invoice amount; r is the Prompt Payment interest rate; and; d is the number of days for which interest is being …

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

Formula for coupon payment

Macaulay Duration Formula | Example with Excel Template Let us take another example and calculate Macaulay Duration using the longer method. Let us take a Bond A $100 value bond that pays a 6% coupon rate and matures in four years. The coupon rate is 8% p.a with semi-annual payment. We can expect the following cash flows to occur: 6 months: $3, 1 year: $3, 5 years: $3, 2 years: $3, 5 years: $3, 3 ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates etc, Please provide us with an attribution link How to Provide … Coupon Rate: Definition, Formula & Calculation - Study.com C = coupon rate i = annualized interest (or coupon) p = par value of bond Coupon Rate Calculation Example Let's look at an example. XYZ Company, the fictitious maker of widgets, is looking to...

Formula for coupon payment. COUPDAYS Function - Formula, Examples, How to Use The COUPDAYS function helps in calculating the number of days between a coupon period's beginning and settlement date. Formula =COUPDAYS (settlement, maturity, frequency, [basis]) The COUPDAYS function uses the following arguments: Settlement (required argument) - This is the settlement date of a given security. How to Calculate a Coupon Payment | Sapling After you've calculated the total annual coupon payment, divide this amount by the par value of the security and then multiply by 100 to convert this total to a percent. Remember the equation: coupon rate formula = (total annual coupon payment) divided by (par value of the security) x 100 percent. Coupon Rate Formula Examples Bond Formula | How to Calculate a Bond | Examples with Excel ... The formula for a bond can be derived by using the following steps: Step 1: Initially, determine the par value of the bond and it is denoted by F. Step 2: Next, determine the rate at which coupon payments will be paid and using that calculate the periodic coupon payments. It is the product of the par value of the bond and coupon rate. Pricing bonds with different cash flows and compounding frequencies Semiannual coupon payments. Many bonds pay coupon interest semiannually. When bonds make semiannual payments, 3 adjustments to Equation 1 are necessary: (1) the number of periods is doubled; (2) the annual coupon rate is halved; (3) the annual discount rate is halved. ... then we can express the general formula for valuing a bond as follows: C ...

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. How to Calculate a Coupon Payment: 7 Steps (with Pictures) To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency. How to use the Excel COUPNUM function | Exceljet Number of coupons payable Syntax =COUPNUM (settlement, maturity, frequency, [basis]) Arguments settlement - Settlement date of the security. maturity - Maturity date of the security. frequency - Number of coupon payments per year (annual = 1, semi-annual = 2, quarterly = 4). basis - [optional] Day count basis (see below, default =0). Version Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture.

Payment Options | Appalachian Electric Cooperative This payment is reviewed monthly with the above formula plus any balance and if warranted, the payment adjusted. The meter will continue to be read each month, and the member’s actual usage will be used to reconcile their account. The Levelized Billing Program is subject to cancellation at any time due to: Termination of electric service by the customer. Failure to … Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Macaulay Duration Formula | Example with Excel Template The Macaulay Duration Formula can be calculated by using the below explanation: Macaulay Duration considers the time, coupon payment, the current yield, par value of the bond and the price to arrive at a number. All this information can be accessed easily, and using the above formula; Duration can be calculated. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The coupon payment is denoted by C, and it is calculated as C = Coupon rate * P / Frequency of coupon payment Next, determine the total number of periods till maturity by multiplying the frequency of the coupon payments during a year and the number of years till maturity.

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

Prompt Payment: Interest Calculator Jun 30, 2022 · The Formula. This is the formula the calculator uses to determine simple daily interest: P(r/360*d) P is the amount of principal or invoice amount; r is the Prompt Payment interest rate; and; d is the number of days for which interest is being calculated. Last modified 06/30/22. Prompt Payment. A program of the Bureau of the Fiscal Service

Answered: The formula (Coupon Payment / Current… | bartleby A: Information Provided: Term = 8 years (2028 - 2020) Coupon rate = 1.625% Yield to maturity = 2.00%…. Q: determine the current market value of the bond. A: Bond valuation is a method of finding the fair value of the bond. Fair value means the present….

How to use the Excel COUPNCD function | Exceljet Below is the formula in F6 reworked with hardcoded values and the DATE function: = COUPNCD (DATE (2019, 2, 15), DATE (2024, 1, 1), 2, 0) ... The Excel COUPNUM function returns the number of coupons, or interest payments, payable between the settlement date and maturity date.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%.

How Can I Calculate a Bond's Coupon Rate in Excel? In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments...

How to Calculate the Price of a Bond With Semiannual Coupon Interest ... Multiplying the results by the eight coupon payments and the one final face-value payment discounts them to $24.27, $23.56, $22.88, $22.21, $21.57, $20.94, $20.33, $19.74 and $789.41, respectively. Summing and Pricing. Add the results of the previous calculations to achieve a total present value. Concluding the example, adding the present ...

Clean Price (Flat Price) of a Bond | Formula & Example Apr 30, 2019 · Where F is the face value, C is the total annual coupon rate, m is the coupon payments per year, D is the days since last payment date and T is the total number of days between coupon payments. Example. Please consider the facts given in the example in article on dirty price.

Coupon Bond - Guide, Examples, How Coupon Bonds Work c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources Thank you for reading CFI's guide on Coupon Bond.

Duration Formula (Definition, Excel Examples) | Calculate ... Duration = 63 years; The calculation for Coupon Rate of 4%. Coupon payment = 4% * $100,000 = $4,000. The denominator or the price of the bond Price Of The Bond The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity.

Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year.

What Is A Coupon Value? Definition And Calculation Here is a coupon rate formula example: An entity issues a $10,000 bond with an annual coupon payment of $450 The coupon rate for this bond is 4.50% ($450 / $10,000)

Clean Price (Flat Price) of a Bond | Formula & Example 30/04/2019 · Where F is the face value, C is the total annual coupon rate, m is the coupon payments per year, D is the days since last payment date and T is the total number of days between coupon payments.. Example. Please consider the …

What is a Coupon Payment? - Definition | Meaning | Example Twenty years later, Mark earns his last payment of $300, plus his original investment of $10,000. In total, Mark has turned his $10,000 into $13,000 over 10 years, which was a safe, and smart, investment for him. Summary Definition. Define Coupon Payments: Coupon payment means the interest installment paid to bond holders.

Bond Formula | How to Calculate a Bond | Examples with Excel … The formula for a bond can be derived by using the following steps: Step 1: Initially, determine the par value of the bond and it is denoted by F. Step 2: Next, determine the rate at which coupon payments will be paid and using that calculate the periodic coupon payments. It is the product of the par value of the bond and coupon rate. It is ...

Post a Comment for "45 formula for coupon payment"