43 the coupon rate of a bond is equal to

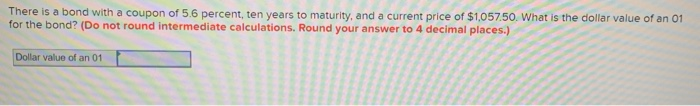

Coupon Rate of a Bond (Formula, Definition) | Calculate ... Therefore, the coupon rate of the bond can be calculated using the above formula as, Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount . Since the coupon (6%) is equal to the market interest (7%), the bond will be traded at par. When is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · The annual coupon rate for IBM bond is therefore equal to $20 ÷ $1000 = 2%. The coupons are fixed; no matter what price the bond trades for, the interest payments always equal $20 per year. So if...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing All types of bonds pay interest to the bondholder. The amount of interest is known as the coupon rate. Unlike other financial products, the dollar amount (and not the percentage) is fixed over time. For example, a bond with a face value of $1,000 and a 2% coupon rate pays $20 to the bondholder until its maturity. Even if the bond price rises or fal...

The coupon rate of a bond is equal to

What Is Coupon Rate and How Do You Calculate It? Dec 03, 2019 · To calculate the bond coupon rate we add the total annual payments then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate.

The coupon rate of a bond is equal to. What Is Coupon Rate and How Do You Calculate It? Dec 03, 2019 · To calculate the bond coupon rate we add the total annual payments then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate.

Post a Comment for "43 the coupon rate of a bond is equal to"